Credits: Grand View Research

Industry Insights

The global synthetic (artificial) leather market size was estimated at 15,780 million meters in 2015. Globally increasing demand from footwear sector is expected to be a key factor propelling the overall market growth. Moreover, artificial leather being a suitable alternative has further augmented the demand in the global market.

It is comprised of a cloth base which is coated with a synthetic resin so that it resembles animal hide on the surface. It is used in various fields of fabrics, footwear, clothing, upholstery & other areas where leather like finish is required and the material is unusable, unsuitable, and cost prohibitive. The production process has evolved over the years for the shell coating to go on top of the synthetic polymer blend.

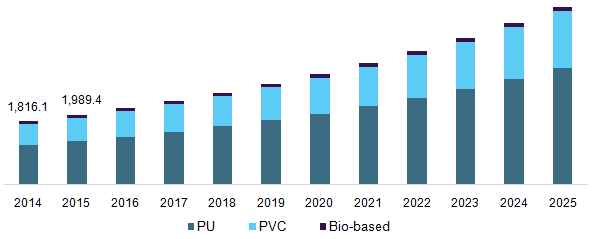

China synthetic leather market volume by product, 2014 - 2025 (Million Meter)

Manufacturers are looking towards increasing their production capacity as the cost of production is low. The market is fragmented and it is dominated by few players. This has resulted in high entry barriers as these manufacturers are focusing on forward and backward integration across the value chain in order to improve their efficiency.

Emerging markets such as China, India Brazil, Malaysia, Thailand and Vietnam are expected to play a major role in the growing demand. Rising demand from the footwear industry in these markets is expected to play a crucial role over the forecast period.

Report Coverage & Deliverables

- Competitive benchmarking

- Market forecasts

- Company market shares

- Market opportunities

- Latest trends & dynamics

Request a Free Sample Copy

Product Insights

PU (Polyurethane) in terms of product quality, variety and yield has been witnessing promising growth. It is the largest product category segment and is expected to observe fastest growth owing to vast range of benefits offered by it. It has several unique properties such as it is waterproof, softer & lighter than real leather and can be easily dry cleaned. Also, it can be torn easily than real hides and remains unaffected from sunlight.

Polyurethane is considered more environment friendly as compared to vinyl based alternatives, as it does not emit dioxins. Also it is more expensive than PVC-based, due to the extensive manufacturing process required.

PVC is another product segment which is expected to witness slow growth rate over the forecast period. PVC was the first form of synthetic leather created in 1920. It was initially produced with carcinogenic chemicals and proved to be an ideal material for applications in furnishing and household items. PVC segment faced huge competition from PU as it gave a sticky feel and was unable to retain the body heat. As a result of which its demand decreased in clothing and bags application segment.

Bio based product is comprised of polyester polyol and has 70-75% renewable content. It is softer and has better scratch resistance properties as compared to PU and PVC. Key market producers are developing new products through collaboration with polyols producers to manufacture synthetic leather. Exponential industrialization, continuous research and development will continue to supplement demand for it in upcoming years.

Application Insights

The global demand has seen a paradigm shift due to rising application across furnishing, automotive, clothing, bags and others. Footwear emerged as the largest application segment and accounted for over 34% of the total market revenue in 2015. Its application is getting nearer to genuine leather and is replacing its applications in handbags, briefcases, car furnishings and clothing at a pacing rate.

Global synthetic leather market volume by application, 2015 (%)

Rising income and economic growth has fuelled the demand in footwear segment. In addition, the market will also continue to grow led by variations occurring in climatic conditions of each country, which needs different types of footwear. Increasing athleisure trend of incorporating athletic shoes in daily lifestyle is also expected to propel the demand in footwear application segment.

The price of a faux leather footwear is three times cheaper than footwear made up from animal hide, which enables large volume purchases, particularly from middle income class groups. Also these foot wears have long durability and are offered in several designs.

Furnishing industry is one of the major application area of the synthetic leather market. As it has become more affordable than animal hide its application in furnishing has emerged. In order to serve varied requirements in furnishing, wide range of synthetic leather is available in market depending on colour, texture and fabric look. Ongoing research and development in this industry has enabled artificial alternatives to be available for marine furnishing as it is salt water resistant.

Faux leather is used in cars, trucks, motorcycles, buses, and agricultural vehicles as it is lighter than animal hide. High elasticity enables comfort and develops resistance against hot & cold temperatures, alcohol and water. It also increases the durability and eases the maintenance. Polyurethane is majorly used in automotive as it is softer and does not give a sticky feel like an animal skin provides. Thus, owing to these advantages several OEM manufacturers prefer it over real leather for applications in this segment.

Application segment of the global faux leather market has increased in manufacturing bags and wallets. They have attained tremendous popularity as they are softer and have high durability. These bags are lightweight, breathable, waterproof, scratch proof and are easy to maintain. Cheaper cost has been a major factor which has contributed to the demand in this segment.

As textile technology is evolving consumer are preferring vegan fashion, which refers to adopting non-leather products. Artificial leather market is gaining considerable demand as it is the most suitable alternative against other forms of leather. Polyurethane is also used in clothing where it is used to create spandex and to add buoyancy to competitive swimsuits.

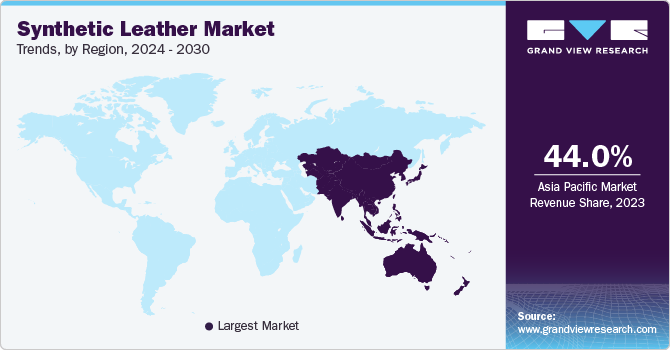

Regional Insights

Asia Pacific dominated the overall faux leather market in 2015 and accounted for over 40% of the overall market revenues. The footwear and automobile industry is anticipated to grow at a rapid rate during the forecast period. China, India and South Korea are expected to be the major growth drivers. Rising disposable income coupled with increasing population pose huge avenues for growth in demand. The region also has

China is the largest revenue generating region in Asia Pacific. The country has a rapidly growing automotive and footwear industry, which are vital application segments. It mainly imports faux leather from India, Korea and Italy. China constitutes around 25% of the global production. It is also among major consumers of animal skin in wide application segments such as automotive, furnishing and clothing.

North America and Europe are expected to observe moderate growth in the global artificial leather market owing to rising trend of adopting cruelty free products. Moreover, animal right laws in several countries have become a major hurdle for natural leather manufacturers. Growing awareness among consumers regarding animal killings mainly owing to the programs run by organizations such as PETA, PAWS, WWF and others has played a major role in increasing demand for other alternatives. Furthermore, the supply demand gap in the natural leather industry is another major factor which is responsible for manufacturers opting artificial alternatives.

Wide product range offered by leading fashion brands such as Baggit, Zara, Puma, Nike and others is further propelling demand for overall artificial leather market in developed countries.

Competitive Insights

Key competitive players include Kuraray Co. Ltd., H.R. Polycoats Pvt. Ltd, Alfatex Italia, Yantai Wanhua Group Co. Ltd., Nan Ya Plastis Corporation, Tejinin Limited and others. Mayur Uniquoters Limited launched a new production facility and has also integrated backward in the value chain. It is now engaged into knitting synthetic fabric in order to manufacture high quality products for domestic and global markets. Mitsubishi Chemicals Corporation, DuPont, and Hanwa Chemical Corporation are analyzed to be leading players of the global market.

Report Scope

Attribute | Details |

Base year for estimation | 2015 |

Actual estimates/Historical data | 2014 - 2015 |

Forecast period | 2016 - 2025 |

Market representation | Volume in million meter, revenue in USD Billion and CAGR from 2016 to 2025 |

Regional scope | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

Country scope | U.S., Canada, Germany, China, India, Italy, France, UK, Japan, South Korea |

Report coverage | Volume & revenue forecast, company share, competitive landscape, growth factors and trends |

15% free customization scope (equivalent to 5 analyst working days) | If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments covered in the report

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global synthetic leather market on the basis of product, application and region:

Product Outlook (Volume, Million meter; Revenue, USD Billion, 2014 - 2025)

PU

PVC

Bio based

Application Outlook (Volume, Million meter; Revenue, USD Billion, 2014 - 2025)

Furnishing

Automotive

Foot wear

Bags & wallets

Clothing

Others

Regional Outlook (Volume, Million meter; Revenue, USD Billion, 2014 - 2025)

North America

U.S.

Canada

Europe

Germany

Italy

France

UK

Asia Pacific

China

India

Japan

South Korea

Central & South America

Middle East & Africa